Describe the Payroll Record Keeping Methods Presently Used

Maintains compliance with tax laws. Adopting best practice record-keeping makes it easier to keep track of employee details identify payroll mistakes and keeps a business running efficiently.

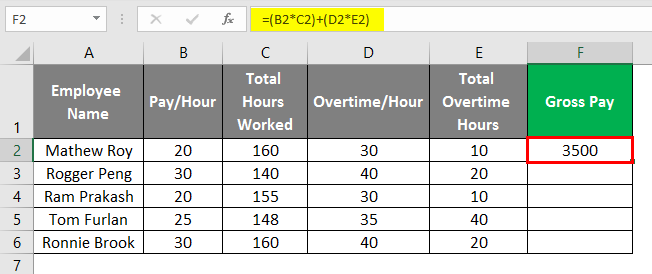

Payroll In Excel How To Create Payroll In Excel With Steps

Easy to back up and keep safe in case of fire or theft.

. Employers keep related records including but not limited to. There are various manual filing cabinets and electronic computer-aided and online ways to record store and retrieve information. In addition the employer must preserve any records made in the regular course of the.

3 Mention what all functions are involved in Payroll. Records paperwork for new hires. Employers are required to keep several records on file for each employee including payroll records.

A small payroll dept one or two people needs to set up check points outside the payroll dept eg. Maintaining the Right Records. Regardless of the method chosen businesses must ensure they retain their payroll records for the specific length of time mandated by federal state and local laws.

Payroll Accounting and Controls. Our Focus For Today 2017 The Payroll Advisor 5 The importance of record keeping in a payroll department Regulatory agencies with payroll record keeping requirements including. Lock down the pay period in the payroll module for the period just completed to prevent unauthorized changes.

If in-house software is being used archive the data. Employers should keep records of hours worked for all employees including pieceworkers. Explain how payroll interacts with the accounting system and the associated record keeping controls and measurements.

You are legally required to keep records of all transactions relating to your tax and superannuation affairs as you start run sell change or close your business specifically. Understand the payroll outsourcing process and the pros and cons of outsourcing payroll. Record-keeping is a primary stage in accounting that entails keeping a record of monetary business transactions knowing the correct picture of assets-liabilities profits and loss etc.

Record keeping and verifying the reliability of pay data. It also helps avoid fines for doing the wrong thing. Easy to generate reports.

If a manual system is used put the payroll register in locked storage. A record of the employees reported tips on a. Human resources or Accounting Do not keep any one complete function under the control of one dept or one person.

Lock Down the Period. The system should be functional accurate reliable and user-friendly. Our Focus For Today 2016 The Payroll Advisor 5 The importance of record keeping in a payroll department Regulatory agencies with payroll record keeping requirements including.

Payroll Accounting and Controls Multiple-choice lesson exams. Keeping accurate and up-to-date records is vital to the success of your business. Payroll record keeping is important for every business even one that employs only one or two people.

Functions involved in Payroll involves Balancing and reconciling payroll data. Department of Labor IRS Child Support Others Details of exactly what data needs to be saved and in what format can it be kept Does Sarbanes-Oxley still matter in 2016 for record keeping. Any documents containing details of any election choice.

Good records help you to minimise losses manage cash meet any legal regulatory and taxation authority requirements and improve financial analytics. But with all the forms and documents it can be overwhelming and confusing to determine which records to keep. Describe various payroll record-keeping methods.

According to the FLSA you must keep payroll records for at least three years eg wages paid benefits etc. Your electronic options include accounting software web-based systems and spreadsheets. Less physical storage space than a manual system.

Financial record keeping. Each association should decide on a record-keeping system that suits its particular needs circumstances and resources availability of space or computers. Department of Labor IRS Child Support Others Details of exactly what data needs to be saved and in what format can it be kept Does Sarbanes-Oxley still matter in 2016 for record keeping.

Payroll record keeping is an essential data management task for any employer and it goes far beyond weekly paycheck calculations quarterly filings and end-of-year tax forms. And store wage computation records eg time cards work schedules etc for at least two years. If payroll processing is outsourced this is handled by the supplier.

Payroll Giving Scheme documents including the agency contract and employee authorisation forms. Record Keeping for a Small Business Participant Guide Money Smart for a Small Business Curriculum Page 8 of 18 Payroll and Personnel If you hire employees your record keeping capacity needs to be advanced enough to comply with numerous local state and federal payroll and personnel legal requirements. Payroll records Accounting for employee earnings and deductions Payroll record keeping methods Chapter 9 Employer payroll taxes Accounting for employer payroll taxes Reporting payment responsibilities Workers compensation insurance Class Review Problems Chapter 8 Demonstration Problem Chapter 9 Demonstration Problem Textbook.

Your records must show youve reported accurately and you need to. Problem 12 - Correct Which of the following is a common approach used by medium- and large-size businesses for payroll record keeping. Payroll Record Keeping Training Tips For Handling Your Payroll Records Payroll Record Keeping And Payroll Record Retention Requirements From the pay stubs for your employees first payroll checks of the year to the Form W-2 at year-end the Payroll Department creates thousands and thousands of records each year.

Depositing and reporting taxes. You can keep payroll records longer if youd like. AA payroll processing center bAn RFID cCard scanning dSelf-reporting Feedback Correct.

Hold onto employment tax documents eg Forms W-4 for at least four years. A payroll processing center is a business that sells payroll record-keeping services. They use payroll software which provides the payroll-related reports and documentation necessary to support compliance and updates records each time payroll is run.

Your accountant can help you set up a record-keeping system. Name address occupation and wages paid to each employee payroll records and records of other forms of compensation dates of hire dates of promotion and dates of pay increases. Overview of record-keeping rules for business.

Any documents related to your businesss income and expenses. Sokolow said the payroll records must identify the employee as a tipped employee and employers must keep. Some advantages of digital record keeping include.

As it is with other employer-based record keeping payroll information must be archived and organized in a way that it can be readily available. Use our templates to help manage record-keeping. In addition it assists in maintaining control of the expenses to minimize the expenditure and have important information for legal and tax purposes.

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Journal Entries For Wages Accountingcoach

Pin By Senate Systems On Erp Employee Management Hr Management Business Management

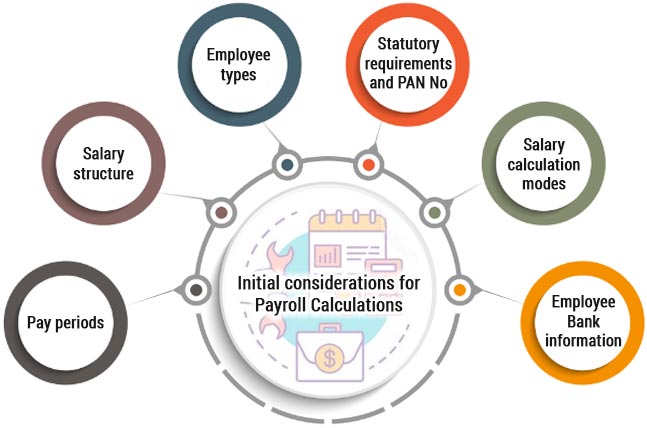

What Is Payroll And How Are Payroll Calculations Done

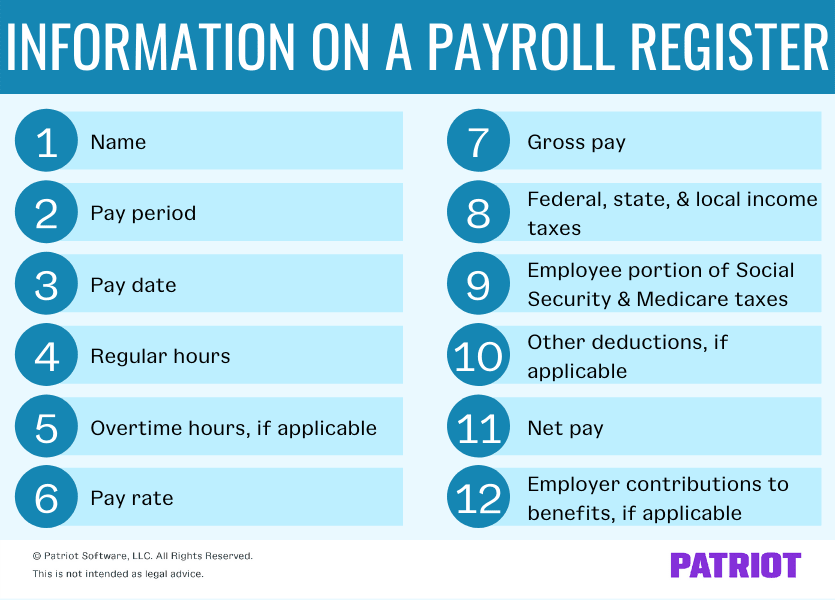

Payroll Register What It Is What Is On It More

Template Net Employee Record Templates 32 Free Word Pdf Documents Download 15f4e244 Resumesample Resumefor Schedule Templates Records Online Planner

Payroll Journal Entries For Wages Accountingcoach

Payroll Statement Template Statement Template Payroll Template Payroll

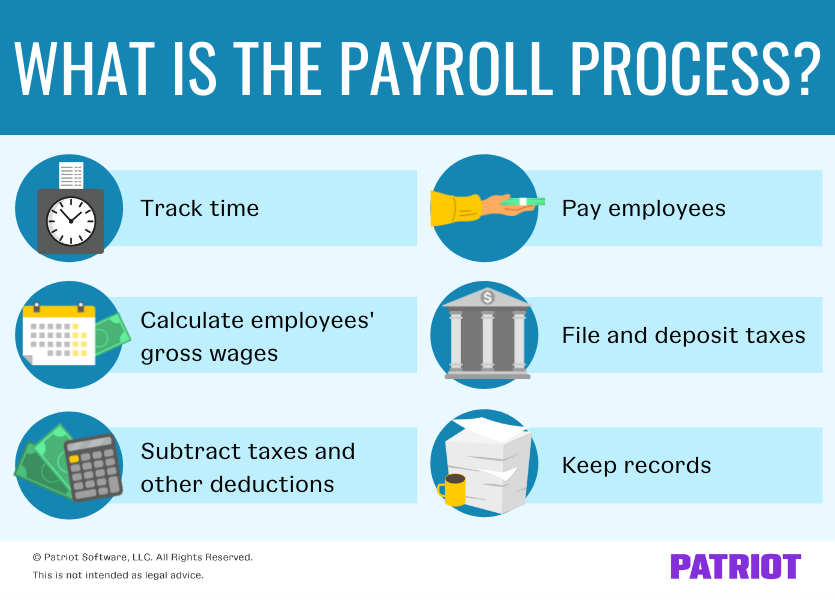

What Is Payroll Definition Detailed Overview

Payroll Audit Objectives Process Checklist Aihr

Payslip Template Excel Online Payslip Template Word Template Payroll Template Lesson Plan Templates

Do You Know About Trial Balance Accounting Education Financial Literacy Lessons Bookkeeping Business

Employee Time Tracker And Payroll Template Imprimable Service Rh Modele Facture

Payroll Register What It Is What Is On It More

What Are Payroll Records Maintaining And Organizing Adp

10 Management Techniques To Improve Productivity Management Techniques Improve Productivity Management

What Is Cloud Accounting Software Infographic Cloud Accounting Small Business Accounting Software Small Business Accounting

Comments

Post a Comment